The hammer and inverted hammer candlestick patterns are among the most important tools in technical analysis. Traders use these patterns to identify potential price reversal points on charts. Due to their simplicity and relatively high accuracy, they are highly popular among traders. You can apply these patterns on various analytical platforms such as TradingView to better analyze price trends and make more precise trading decisions. In this article, we will introduce both patterns and explain how to identify them on candlestick charts.

What Is the Hammer Pattern?

The Hammer pattern is a bullish reversal pattern that typically forms after a downtrend. It occurs when the price of an asset drops significantly during the trading period but later recovers and closes near the opening price.

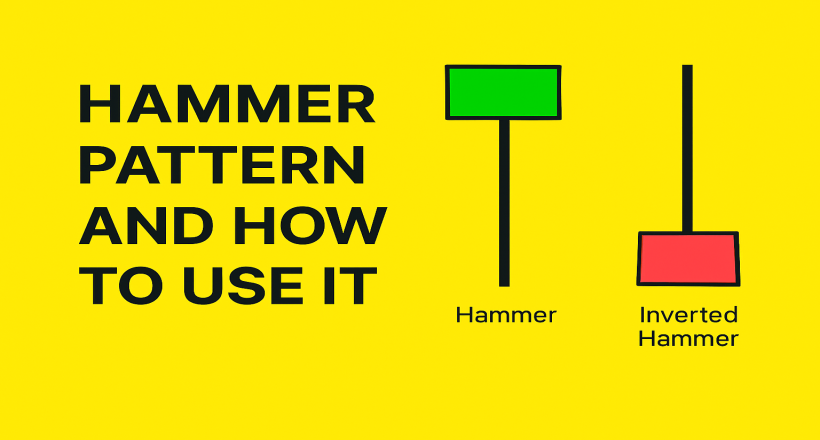

As a result, a candlestick resembling a hammer appears — with a small body at the top and a long lower shadow. The lower shadow should be at least twice the size of the body. This structure indicates that selling pressure was initially strong, but buyers entered the market and pushed the price back up. Therefore, a hammer candle is considered a potential sign of a trend reversal from bearish to bullish.

In this pattern, the candlestick body represents the difference between the opening and closing prices, while the shadows display the range of price movement during that time period. When a hammer appears near support zones, it is often interpreted as a positive signal for potential price recovery.

How to Identify the Hammer Pattern in Technical Analysis

The hammer pattern is one of the simplest and most recognizable candlestick formations. It can be identified using a few visual characteristics:

Why the Hammer Pattern Forms

A hammer typically appears at the end of a downtrend, signaling weakening selling pressure and the possible return of buyers. It shows that sellers attempted to push prices lower but were eventually overpowered by buyers, who managed to drive the price back up toward the opening level.

This pattern usually forms after several consecutive bearish candles and suggests that the market may be finding a bottom. The appearance of a shape resembling the letter T on the chart acts as an early indication of a potential trend reversal to the upside.

Confirming the Hammer Pattern

To confirm the validity of the hammer pattern, traders often wait for the next candlestick. If the following candle closes above the hammer’s closing price, the pattern is considered confirmed. This increases the likelihood of a price rise and the beginning of a bullish trend. Many traders enter long positions or close their short trades at this confirmation stage.

What Is a Hammer Candlestick?

A Hammer candlestick is a well-known reversal signal in technical analysis that resembles the letter T. It forms when the price of an asset declines during the session but then recovers, closing near its opening level. The result is a small body with a long lower shadow. This pattern usually develops after a period of price decline and serves as an indication of a potential reversal.

Psychology Behind the Hammer Pattern

The hammer pattern reflects the weakening power of sellers and the reentry of buyers into the market. When the price drops initially but later rebounds, it shows that sellers can no longer push the price down effectively. This pattern often indicates that the market has reached its bottom and is preparing for a possible bullish reversal.

For confirmation, traders look for the next candle to close above the hammer’s closing price. If that happens, it validates the reversal signal and increases the chances of an upward movement.

Introduction to the Inverted Hammer Pattern

The Inverted Hammer pattern, as the name suggests, is the reversed version of the classic Hammer candlestick and visually resembles an upside-down hammer. This pattern typically appears at the end of a downtrend and serves as a warning signal for a potential bullish reversal. In this pattern, the long upper shadow indicates that buyers tried to push the price higher but were unable to fully take control of the market.

How to Identify the Inverted Hammer Pattern

To correctly identify the Inverted Hammer pattern, pay attention to the following key points:

• The pattern must appear after a downward trend.

• The upper shadow should be at least twice the size of the candlestick’s body.

• The lower shadow is either very short or completely absent.

• The candle body is positioned near the lower end of the price range.

In short, this pattern forms during bearish conditions and signals the market’s attempt to shift direction upward.

How to Use the Inverted Hammer in Trading

The Inverted Hammer usually forms at the bottom of a chart, signaling a possible reversal from a bearish to a bullish trend. The longer the upper shadow, the higher the probability of a rebound. In addition:

• If the opening price of the candle is lower than the closing price of the previous candle, the reversal signal is stronger.

• Increased trading volume during the pattern’s formation confirms the strength of buyers.

• A green (white) body shows bullish momentum, while a red (black) body indicates buyer weakness.

In essence, the Inverted Hammer acts as a warning for a potential upward movement, not a guarantee of it.

Confirming the Inverted Hammer Pattern

To validate the reliability of this pattern, traders should examine several factors:

• The upper shadow must be more than twice the size of the real body.

• When the new candle opens with a price gap below the previous candle, the signal becomes stronger.

• A spike in trading volume during pattern formation indicates buyer activity and increased market demand.

Such volume confirmation is often a strong sign of the market’s intention to start a bullish move.

Psychology Behind the Inverted Hammer

This pattern commonly appears at the end of bearish trends, when sellers attempt to push prices even lower but buyers re-enter the market to prevent further decline. The long upper shadow reflects renewed buyer confidence and the market’s effort to change direction. Therefore, the Inverted Hammer often serves as an early indication that the bearish phase might be ending and a new bullish phase could be emerging.

Drawbacks and Limitations of the Hammer and Inverted Hammer Patterns

No technical analysis pattern performs flawlessly in all situations. Just like any other trading strategy or setup, Hammer and Inverted Hammer patterns can sometimes fail. Hence, traders should avoid making buy or sell decisions based solely on these patterns. To improve accuracy, it’s essential to use additional tools such as oscillators, trendlines, and volume indicators.

Although these patterns are visually simple and easy to spot, novice traders might misinterpret them. A common mistake is confusing the Inverted Hammer with the Shooting Star pattern, as both have small bodies and long upper shadows, yet they carry opposite implications.

Hammer and Inverted Hammer Patterns in Cryptocurrency Trading

Both the Hammer and Inverted Hammer are considered bullish reversal patterns and are widely used across all financial markets, including cryptocurrency. Crypto traders often rely on these formations to identify potential reversal zones and confirm entry or exit signals.

However, these candlesticks merely reflect short-term market sentiment and should not be used in isolation. Combining them with other technical analysis tools provides more reliable and precise trading outcomes.

Conclusion

To succeed in crypto trading, relying on a single pattern is never enough. The best approach is to enhance your analytical knowledge and become familiar with various candlestick formations to confidently identify profitable opportunities. If you aim to invest wisely in the crypto market, dedicate time and effort to mastering technical analysis for long-term success.