A Complete Guide to the Martingale Strategy for Buying and Selling Cryptocurrencies

In the world of financial markets, one of the most well-known yet controversial trading methods is the Martingale Strategy. Originally introduced in the 18th century as a betting technique, the Martingale system is now widely used in cryptocurrency trading, forex, and stock markets as a risk management method aimed at recovering losses and improving profitability.

In this article from BestChanger, we’ll dive deep into the concept of the Martingale Strategy, how it works in the crypto market, its advantages, disadvantages, key principles, and practical examples.

Definition of the Martingale Strategy

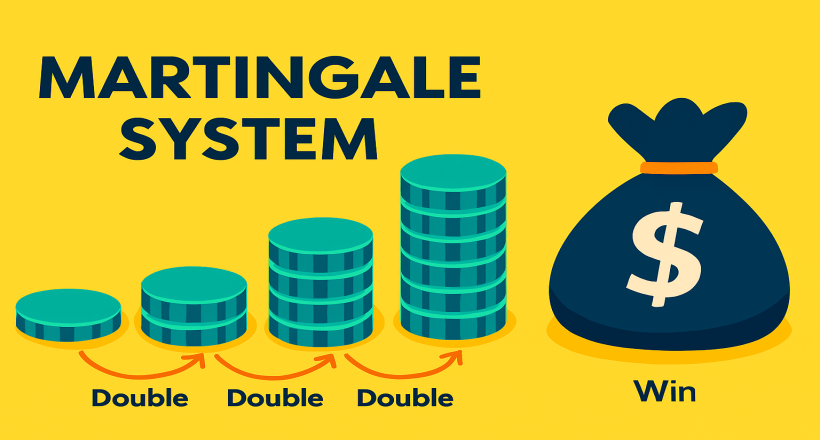

The Martingale Strategy is based on a simple principle:

When you lose a trade, you double your next position size so that when you eventually win, you recover all previous losses and make a small profit.

In simpler terms, this method involves increasing trade size after every loss to cover previous losses once a profitable trade occurs.

How the Martingale Strategy Works in Cryptocurrency

In the volatile and unpredictable crypto market, traders use the Martingale Strategy to average down their entry price and improve their breakeven point.

For example, imagine you bought $100 worth of Bitcoin at

$45,000.

If the price drops to $40,000, instead of closing the trade, a

Martingale trader doubles the investment, lowering the average entry

price.

As a result, when the price rebounds slightly, the position turns profitable

even before reaching the original entry price.

How to Implement the Martingale Strategy in Crypto Trading

To apply the Martingale Strategy effectively, traders should follow these key steps:

1. Choose an Entry Point

Base your initial entry on technical or fundamental analysis, not random decisions.

2. Define the Initial Trade Size

Start small so that you can afford multiple rounds of doubling if the market moves against you.

3. Double the Trade Size After a Loss

Each time the market goes against you, increase the trade size by 2x or a smaller multiplier like 1.5x, depending on your risk tolerance.

4. Calculate the New Average Entry Price

Each new position lowers your average entry price, making it easier to reach profitability on a rebound.

5. Exit at the Right Time

Once you hit your target profit, close the trade immediately to avoid unnecessary exposure.

Advantages of Using the Martingale Strategy in Crypto Trading

Disadvantages and Risks of the Martingale Strategy

While the strategy looks attractive, it carries significant risk if not managed properly:

Using the Martingale Strategy in Crypto Futures Trading

In Futures markets, using the Martingale system is

extremely risky since each doubling increases the liquidation risk.

It’s recommended to:

Key Tips for Safe Use of the Martingale Strategy

Conclusion

The Martingale Strategy is one of the most fascinating yet

dangerous trading systems in the crypto market.

When used correctly, it can help recover temporary losses and generate profits

from price volatility.

However, without solid risk management and proper market analysis, it

can quickly lead to total capital loss.

Therefore, the Martingale Strategy should be viewed as a supplementary tool rather than a standalone system, ideally used alongside technical and fundamental analysis with clear risk parameters.